California Capital Gains Tax Rate 2025

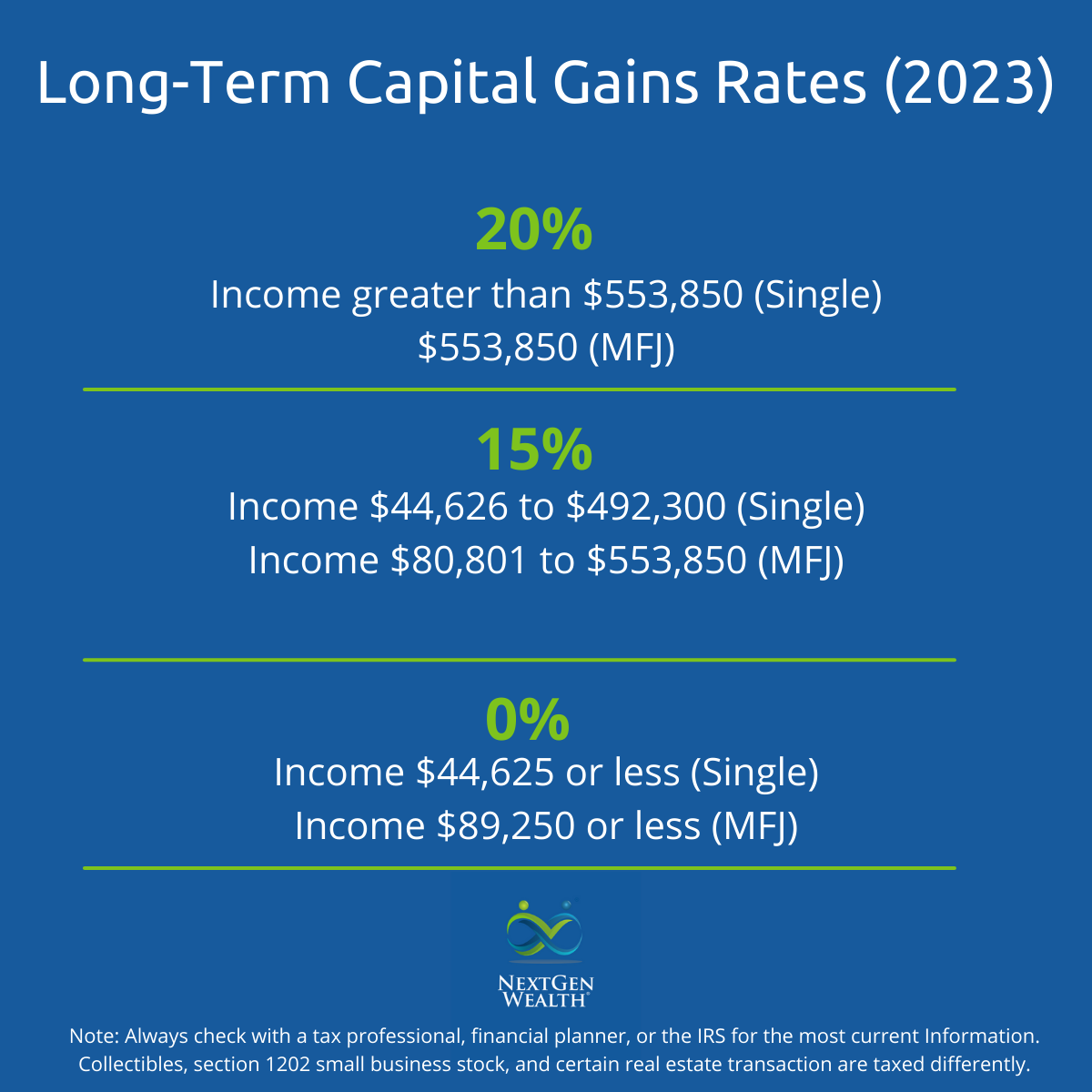

BlogCalifornia Capital Gains Tax Rate 2025. The capital gains tax rates for 2025 and 2025. The tax rate for a capital gain depends on the type of asset, your taxable income, and how long you held the property sold.

The capital gains tax rates for 2025 and 2025. By paying 23.8% plus 13.3%, californians are paying more on capital gains than virtually anyone else in the world.

Capital Gains Tax Residential Property California at Juan Roberts blog, In addition to a federal capital gains tax, you might have to pay state capital gains taxes.

2025 Long Term Capital Gains Tax Brackets Norry Malynda, The capital gains tax rates for 2025 and 2025.

Capital Gains Tax Calculator 2025/25 Christian Murray, The tax rate is determined by an individual’s taxable income and filing status.

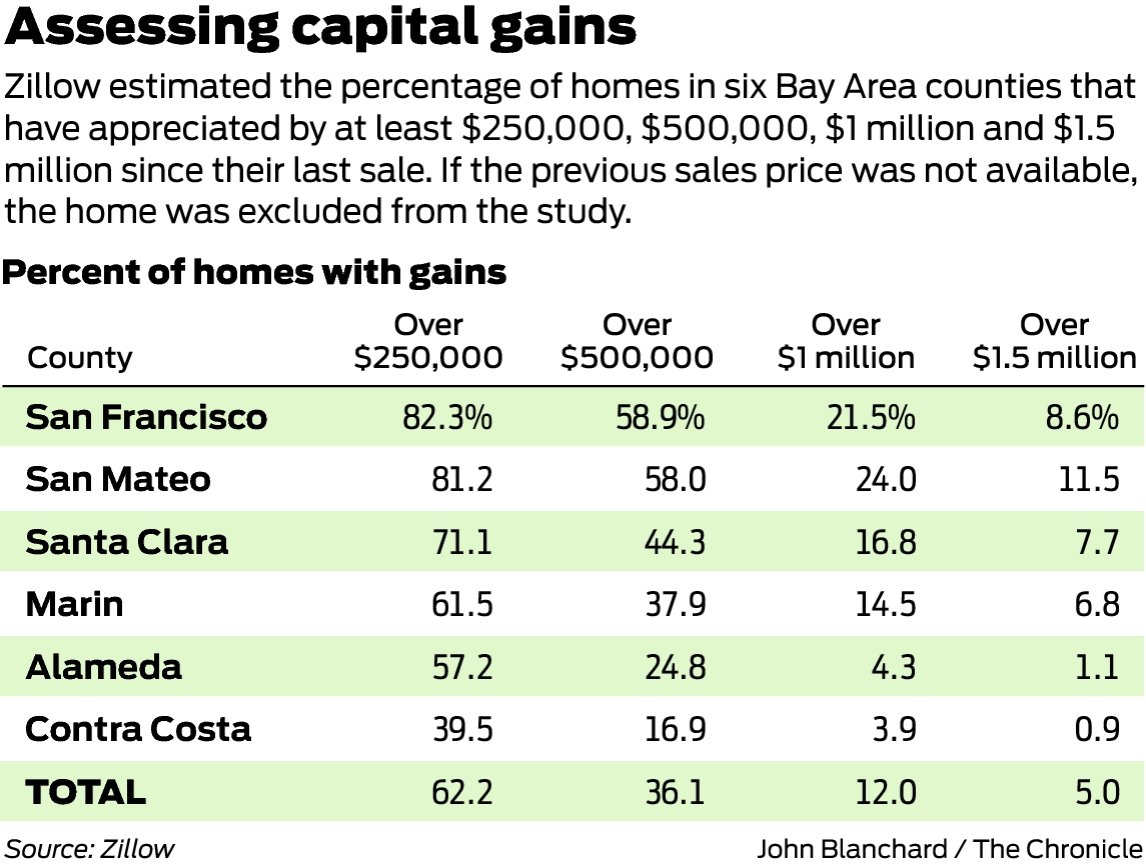

T230017 Distribution of Individual Tax on LongTerm Capital, The state taxes capital gains at a rate of 13.3% for most taxpayers, in addition to the federal capital gains tax rate.

California Capital Gain Tax Explained YouTube, Discover the complexities of capital gains tax rates and how inflation plays a role.

Capital Gains Tax On Sale Of Primary Residence In California Tax Walls, To report your capital gains and losses, use u.s.

Capital Gains Tax Rate 2025/25 202424 Ethyl Janessa, By paying 23.8% plus 13.3%, californians are paying more on capital gains than virtually anyone else in the world.

California Capital Gains Tax Rates, Calculations, and How to Save, The state treats capital gains as regular income,.

new capital gains tax plan Lupe Mcintire, The tax rate on capital gains in california is determined by your income.